If your store doesn't offer Apple Pay now may be the time to consider adding it as a payment option to increase sales and conversions. Apple Pay makes a fast, seamless, and secure checkout for your customers. However, in the past it, was only available on Apple iPhones, iPads, and Safari for Mac. Apple is now rolling out Apple Pay for the web for every browser on Mac, PC, and more. Customers can now use Apple Pay from any computer and securely complete payment on their iPhone or iPad by scanning a code displayed in the browser.

Kevin Richards, CEO of Ventura Web Design & Marketing, says "Apple Pay has always been a game changer for ecommerce, but now, with this new update, Apple Pay is essential for all ecommerce websites."

How it works:

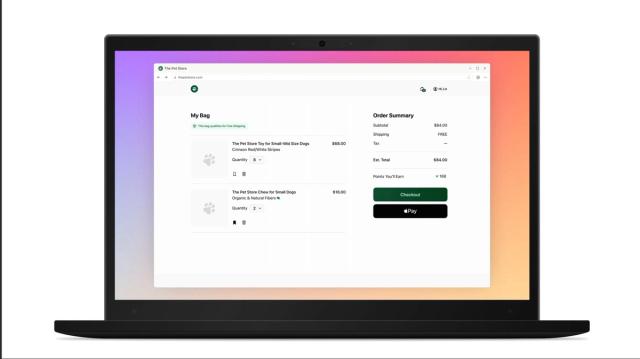

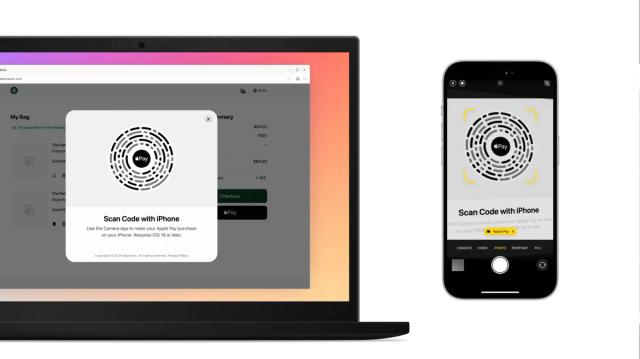

Customers shopping on your store using a laptop or desktop on a browser other than Safari on Mac, such as Google Chrome on Windows, click on the Apple Pay button during checkout and a scannable code pops up on the screen.

They scan the code with the camera on their iPhone or iPad using iOS 18 or above.

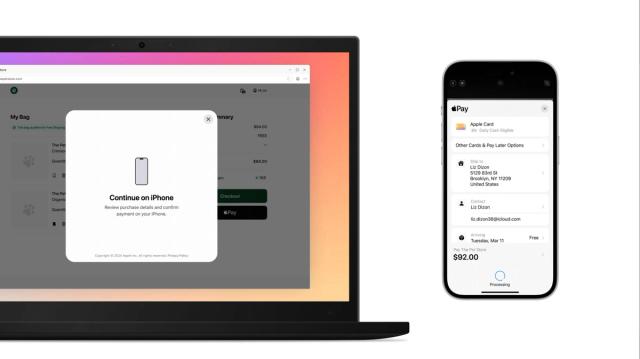

They complete the payment process securely and privately. This makes online ecommerce purchases very easy. The iphone and ipad enable frictionless checkout for your customers using any browser.

Still not sure if you should add Apple Pay as a payment method on your shop? There are many other compelling reasons to do so.

1. Enhanced Customer Experience

• Faster Checkout: Apple Pay streamlines the checkout process with one-touch or Face ID/Touch ID authentication, reducing friction and cart abandonment.

• Convenience: Customers don’t need to manually enter credit card or billing details, making it more user-friendly.

2. Higher Conversion Rates

• Reducing the number of steps in the payment process leads to fewer abandoned carts. Merchants often see higher conversion rates for mobile transactions with Apple Pay.

3. Improved Security for Customers

• Apple Pay uses tokenization and encryption to protect card details, which are never shared with the merchant.

• Face ID/Touch ID adds an additional layer of biometric security, reducing fraudulent transactions.

4. Increased Mobile Adoption

• As mobile shopping grows, Apple Pay provides a seamless mobile checkout experience, capitalizing on the rise of smartphone-driven purchases.

5. Appeal to Tech-Savvy Customers

• Apple Pay attracts consumers who prefer modern, contactless payment methods. Offering it signals that your business is tech-forward and customer-centric.

6. Loyalty and Trust

• Apple is a trusted brand, and offering Apple Pay can increase confidence in your checkout process. Customers associate it with reliability and safety.

7. Reduced Payment Errors

• Since customers don’t need to manually type payment details, there are fewer typos and fewer failed transactions due to incorrect information.

8. Competitive Advantage

• Many competitors are already offering Apple Pay. By accepting it, you meet customer expectations and keep up with industry trends.

9. No Extra Fees

• Apple Pay doesn’t charge merchants additional fees beyond standard transaction costs, making it cost-effective to implement.